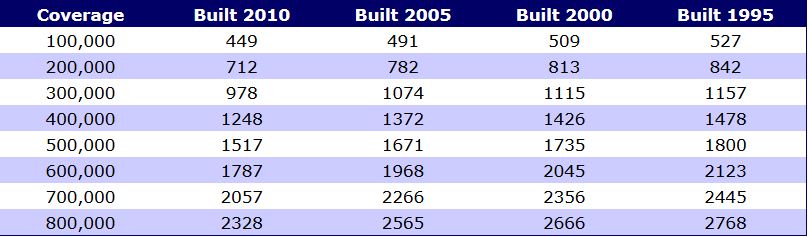

Homeowner's Insurance

Estimated annual premium rates above are based on:

- 1% deductibles for both Wind/Hail and Other Peril (1% of Coverage amount)

- HO-3 coverage form with Replacement Cost coverage for structure and contents

- $300k personal liability limit; (no aggressive pets)

- Assumes primary residence use; no multiple-policy discounts; single-family home

- 100% Brick Veneer exterior; composite shingle roof; Ranch-style; concrete slab

- Home within 1k feet of fire hydrant; 2 miles of fire station; PPC 3

- No fireplace, trampoline, pool, in-home business use, or central alarm system

Note that these estimated annual rates above do not include the endorsement of Foundation Coverage. To add such coverage at 15% of the home's replacement cost, multiply the above rates by 1.25 for an estimated total premium.

Benefits of Home Warranty Coverage

To the Seller:

- Home may sell faster and at a higher price.

- Optional coverage during the listing period.

- Protection from after-sale legal disputes.

- Increases marketability of home.

To the Buyer:

- Warranty coverage on major systems and built-in appliances.

- Protects your cash flow.

- Puts a complete network of qualified service technicians at your fingertips.

- Low deductible.