Housing inventory continues to fall nationwide, as we continue to see home availability dip for the eighth consecutive quarter. In fact, the end of the first quarter in 2017 recorded a low for home inventory in the United States. Trulia conducted an analysis of supply and affordability for the three housing segments – starter homes, trade-up homes, and premium homes – explaining the correlation between our declining inventory and home prices.

Three factors that go into the analysis include:

- The number and share of inventory that are starter, trade up, and premium homes

- The change in share and number of these homes

- The affordability of those homes for each type of buyer

A more in depth look at the Trulia’s home inventory analysis can help explain the current housing market in San Antonio, Austin, and other cities across the country.

Housing Inventory, From A National Perspective

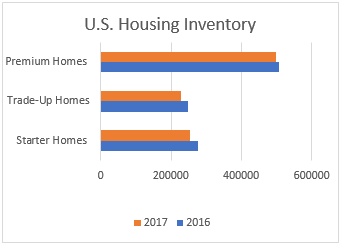

It’s no lie that the homes are shrinking on a national level, but the reduction at each segmented level tells a larger story. Within the past year, starter homes have dropped 8.7 percent on average while trade-up homes have fallen 7.9 percent and premium homes at 1.7 percent.

This disjointed drop has actually caused affordability issues, making it more difficult for home owners to upgrade to a new home. According to research, homebuyers must spend 2.9 percent more of their income when purchasing a starter home and 1.6 percent more when progressing to a trade-up home. Even those moving to a premium home are spending .9 percent more of their income, as opposed to last year at this time.

Housing Inventory In Texas

On average, it has been found that the more valuable a metro’s housing market is compared to pre-recession levels, the larger the drop in inventory it has seen. So, what does that mean for Texas? The answer depends on what city you are living in. Homeowners in Austin have seen a 19 percent decrease in homes over the past five years and that could be due to the 116 percent home value recover when comparing the home value in Austin before the recession. This is above the national trend line, which creates a promising future for those living in Austin. The San Antonio market follows closer to the national trend line with a home value recovery peak at 105 percent, causing a 38 percent decrease over the past five years.

While these cities in Texas are following the same downward trend, homeowners in these metros have it pretty well off when compared to other cities. Those living in Denver, for example, have experienced otherwise. The Denver housing market has seen at 136 percent home value recovery, which has resulted in a 61 percent decrease of homes over the past five years, making it extremely difficult to buy a home in Denver.

To get expert advice and to view the finest in southern San Antonio homes for sale, contact JB Goodwin REALTORS® today.

Posted by on

Leave A Comment